A spike in volume after it breaks out is a good sign that a bigger move is on the cards. This will enable you to ensure that the move is confirmed before opening your position.Īnother common signal of a wedge that’s close to breakout is falling volume as the market consolidates. As a result, you can wait for a breakout to begin, then wait for it to return and bounce off the previous support area in the ascending wedge. Alternatively, you can use the general rule that support turns into resistance in a breakout, meaning the market may bounce off previous support levels on its way down. Essentially, here you are hoping for a significant move beyond the support trendline for a rising wedge, or resistance for a falling one.įor ascending wedges, for example, traders will often watch out for a move beyond a previous support point.

One way to confirm the move is to wait for the breakout to start. Not all wedges will end in a breakout – so you’ll want to confirm the move before opening your position. Rising wedge vs falling wedge: what’s the difference? You can try out the IG trading platform with a demo account. To spot them, though, you’ll need a platform with powerful charting tools: such as the IG trading platform or MetaTrader 4. Studies have shown that falling wedges lead to breakouts slightly more often than rising ones. This is a sign that bullish opinion is either forming or reforming. But in this case, it’s important to note that the downward moves are getting shorter and shorter.

:max_bytes(150000):strip_icc()/dotdash_Final_Tales_From_the_Trenches_The_Rising_Wedge_Breakdown_Dec_2020-05-e9b97938a4064e2cbe0126c16386a045.jpg)

The falling wedge chart pattern is a recognisable price move that is formed when a market consolidates between two converging support and resistance lines. Open an IG account to start trading them now. Rising wedges can occur on any market that’s popular with technical traders, including indices, forex and stocks. This causes a tide of selling that leads to significant downward momentum. Those waiting to short the market, meanwhile, will jump in.

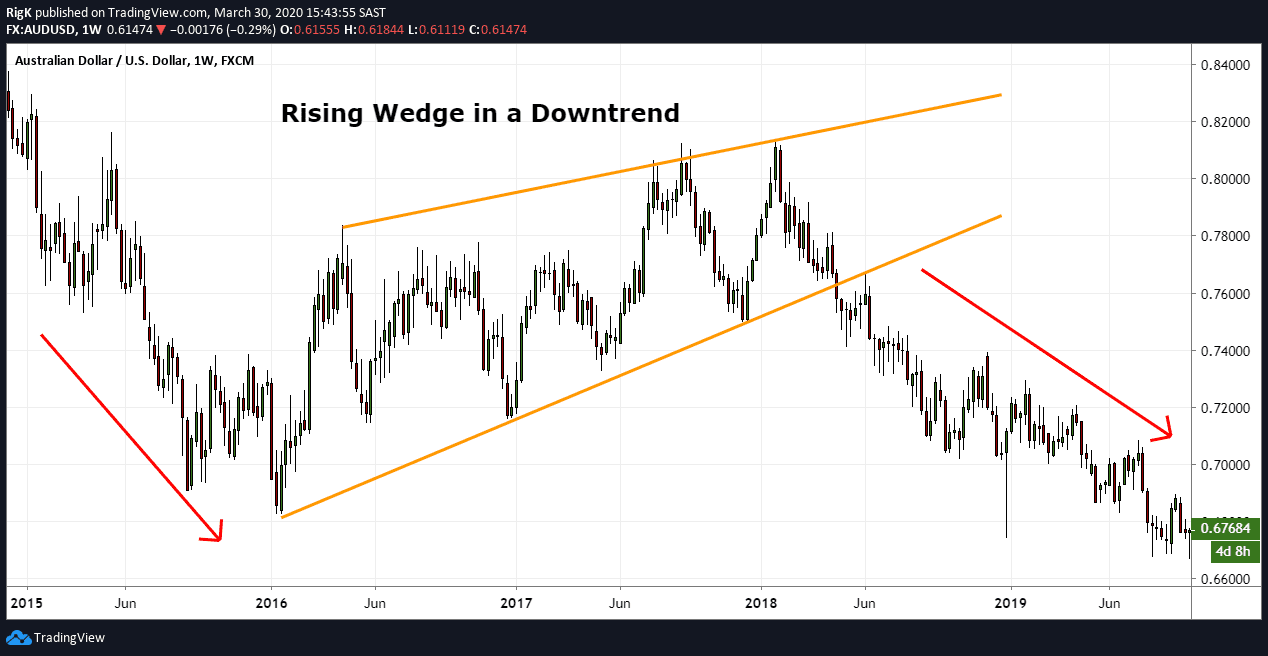

This negative sentiment builds up, so that when the market moves beyond its rising support line, anyone with a long position might rush to close their trade and limit their losses. This is the sign that bearish opinion is forming (or reforming, in the case of a continuation). But the key point to note is that the upward moves are getting shorter each time. After all, each successive peak and trough is higher than the last. When a market is falling, they’re a short-term pause before the bear market takes hold once moreĪt first glance, an ascending wedge looks like a bullish move.

0 kommentar(er)

0 kommentar(er)